2 days ago

Alain Web-creator 🇨🇲 IS a freelance web Developer who create any type of website or web application, #alainwebcreator IS the promoter of the social network #Twitbook24 and the co-founder of the streaming plateform #Promozik TV and #SVES Voting App. 😉

He IS available for partnetship !

Website: https://alainwebcreator.cm

He IS available for partnetship !

Website: https://alainwebcreator.cm

Read more

2 days ago

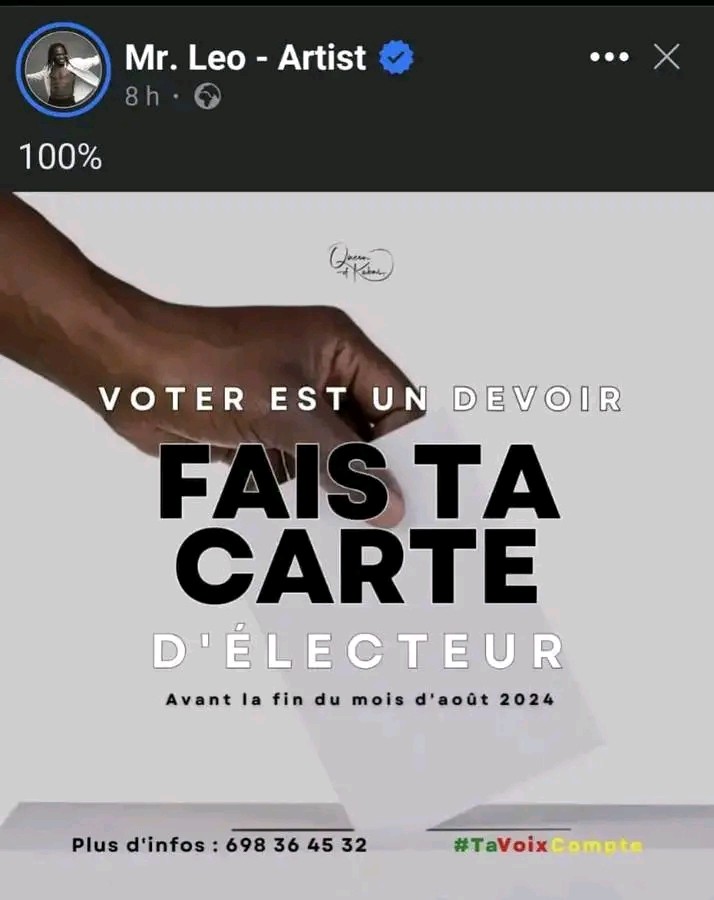

If you want to change thé system in your country , it IS very simple: vote.

Please, don't take army. 🙏

🚨 Long life to democraty , long Life to thé peace in the world ☮️ !

This IS a message of #alainwebcreator , promoter of #SVES (Smart Voting Electronic System)

Please, don't take army. 🙏

🚨 Long life to democraty , long Life to thé peace in the world ☮️ !

This IS a message of #alainwebcreator , promoter of #SVES (Smart Voting Electronic System)

Read more

2 days ago

Do you have your voting carte ? 🤔

#election237 , #elecam , #election2025

#alainwebcreator , conceptor of #SVES App

#election237 , #elecam , #election2025

#alainwebcreator , conceptor of #SVES App

Read more

2 days ago

2 days ago

23 days ago

It is the applicant’s responsibility to ensure they provide sufficient evidence to satisfy you that they meet the UK Visitor rules.

Tap the link to know more:

www.icslegal.com

Tap the link to know more:

www.icslegal.com

Read more

23 days ago

Visitors can undertake multiple permitted activities whilst they are in the UK, but the applicant should be able to explain what their main reason for coming to the UK is at the visa application stage, on entry and when applying to extend their stay.

www.icslegal.com

www.icslegal.com

Read more

24 days ago

For the HPI visa, UK universities are not eligible. If you’re already in the UK on a student visa you may be able to apply for a Graduate visa.

www.icslegal.com

www.icslegal.com

Read more

24 days ago

To be eligible for a High Potential Individual (HPI) visa, you must have been awarded a qualification by an eligible university.

www.icslegal.com

www.icslegal.com

Read more

28 days ago

If you came to the UK on a different visa, you might be able to switch to a family visa to stay with your spouse or partner.

www.icslegal.com

www.icslegal.com

Read more

28 days ago

You can apply to extend your stay with your family member if you’re already in the UK on a family visa.

Contact us to know more:

www.icslegal.com

Contact us to know more:

www.icslegal.com

Read more

29 days ago

Apply for a Graduate Trainee visa if you are on a graduate trainee programme and you want to work for your employer’s UK branch.

www.icslegal.com

www.icslegal.com

Read more

29 days ago

Apply for a Service Supplier visa to provide a service under contract for a UK company.

www.icslegal.com

www.icslegal.com

1 month ago

Apply for a visa to visit the UK if you want to marry or register a civil partnership within 6 months.

www.icslegal.com

www.icslegal.com

1 month ago

Apply for a Youth Mobility Scheme visa to live and work in the UK if you’re from a participating country.

www.icslegal.com

www.icslegal.com

1 month ago

You may be able to extend your stay if you have permission to be in the UK for less than 6 months.

www.icslegal.com

www.icslegal.com

1 month ago

You can apply for a Standard Visitor visa, or if you visit the UK regularly you can choose to apply for a long-term Standard Visitor visa instead.

www.icslegal.com

www.icslegal.com

Read more

1 month ago

Apply for a High Potential Individual (HPI) visa if you've been awarded a qualification by an eligible university in the last 5 years.

www.icslegal.com

www.icslegal.com

Read more

1 month ago

Want to know when and how to appeal against a visa or immigration decision?

Contact us:

www.icslegal.com

Contact us:

www.icslegal.com

1 month ago

Apply to come to the UK as a representative of a news agency, newspaper or news agency and you’re from outside the EEA and Switzerland.

www.icslegal.com

www.icslegal.com

Read more

1 month ago

Apply for a Secondment Worker visa to work for a UK organisation as part of a high-value contract.

Contact us to know more:

www.icslegal.com

Contact us to know more:

www.icslegal.com

Read more

1 month ago

You can apply for horticulture Seasonal Worker visas at any time of year.

Get in touch with us to know more:

www.icslegal.com

Get in touch with us to know more:

www.icslegal.com

1 month ago

You need to apply for poultry Seasonal Worker visas by 15 November each year. Contact us to confirm your eligibility.

www.icslegal.com

www.icslegal.com

1 month ago

Apply for a Youth Mobility Scheme visa to live and work in the UK if you’re from a participating country.

www.icslegal.com

www.icslegal.com

1 month ago

Applicants must be able and intend to work in the UK to qualify on the ancestry visa route.

Contact us to know more:

www.icslegal.com

Contact us to know more:

www.icslegal.com

1 month ago

You may be able to settle permanently in the UK if you have T2 Minister of Religion or Tier 2 (Minister of Religion).

Contact us to know more:

www.icslegal.com

Contact us to know more:

www.icslegal.com

Read more

1 month ago

You may be able to settle permanently in the UK if you have an International Sportsperson, T2 Sportsperson or Tier 2 (Sportsperson).

Contact us know more:

www.icslegal.com

Contact us know more:

www.icslegal.com

Read more

1 month ago

You must have a confirmed job offer before you apply for your Health and Care Worker visa. Contact us to know more:

www.icslegal.com

www.icslegal.com

1 month ago

A Health and Care Worker visa allows medical professionals to come to or stay in the UK to do an eligible job with the NHS, an NHS supplier or in adult social care.

Contact us to know more:

www.icslegal.com

Contact us to know more:

www.icslegal.com

Read more

1 month ago

You can apply for an Innovator Founder visa if your business idea is new. This means you cannot join a business that is already trading.

Contact us to know more:

www.icslegal.com

Contact us to know more:

www.icslegal.com

Read more